BigBear.ai’s Meteoric Rise in the AI-Driven Market: A Detailed Analysis

Introduction: The Surge of BigBear.ai in the AI Boom

The AI sector has emerged as one of the most dynamic and lucrative markets in recent years, with companiesLike BigBear.ai (NYSE:BBAI) leading the charge. BigBear.ai has seen its shares skyrocket by an impressive 93% so far this year, underscoring the immense potential of AI-driven companies. The AI market is projected to expand to a staggering $1 trillion by the early 2030s, and this growth has naturally ignited investor interest. BigBear.ai, specializing in AI-powered decision-making solutions, has carved out a niche for itself, particularly in the U.S. defense sector. This strong government backing has drawn comparisons to another major player in the AI space: Palantir Technologies.

BigBear.ai vs. Palantir: A Tale of Two AI Giants

While BigBear.ai has shown promising growth, investor Oliver Rodzianko cautions that the company still lags significantly behind Palantir in terms of market dominance and revenue. Palantir, a well-established leader in the AI sector, boasts $2.9 billion in total revenue, capturing approximately 1.43% of the market share. In contrast, BigBear.ai’s revenues stand at $155 million, representing a mere 0.0775% of the market. This disparity highlights the challenges BigBear.ai faces in competing with Palantir, despite its recent success. Rodzianko likens the situation to the rivalry between NVIDIA and AMD, where one company clearly outpaces the other in market leadership.

Valuation and Growth Potential: Where BigBear.ai Stands

Despite trailing Palantir in revenue and market share, BigBear.ai holds an advantage in terms of valuation. Palantir currently trades at a lofty price-to-sales (P/S) ratio of approximately 90x, whereas BigBear.ai’s P/S ratio is significantly lower at around 9x. This disparity makes BigBear.ai appear more reasonably valued compared to its competitor. However, Rodzianko argues that this valuation advantage alone is not sufficient to justify investing in BigBear.ai at its current price point, especially following the stock’s recent surge. The investor emphasizes that while BigBear.ai may be a strong company, its stock is not currently positioned as a Wise investment choice.

Market Saturation and the Challenges Ahead

Rodzianko also points to the broader market dynamics as a potential headwind for BigBear.ai. The AI sector is rapidly becoming saturated with new players vying for market share, even as established leaders like Palantir work to consolidate their positions. This increasing competition could limit BigBear.ai’s ability to achieve outsized growth, making it harder for the company to stand out in an increasingly crowded field. Furthermore, Rodzianko notes that BigBear.ai’s reliance on equity financing and stock compensation—a common trait of younger companies—poses a risk of dilution for shareholders. The company’s weighted average of shares outstanding has nearly doubled over the past three years, from 107 million to 210.2 million, a trend that could further dilute shareholder value.

Wall Street’s Perspective: Analyst Consensus and Future Outlook

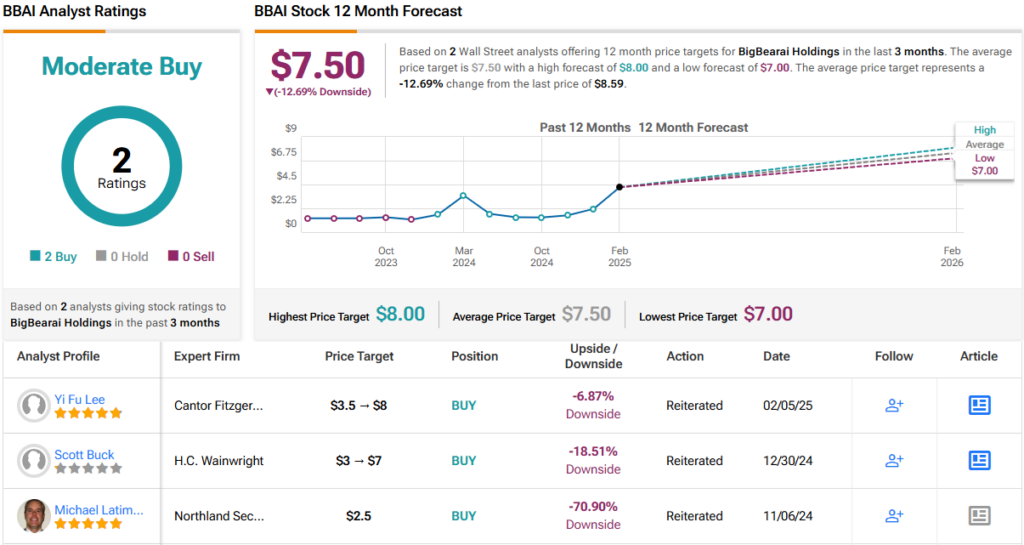

Despite the cautioned outlook from Rodzianko, BigBear.ai remains relatively under the radar on Wall Street, with only two recent analyst reviews. Both of these reviews rate the stock as a "Buy," resulting in a Moderate Buy consensus rating. However, following the significant rally in BigBear.ai’s share price this year, analysts are anticipating a potential 13% downside in the coming months. This outlook is based on an average price target of $7.50, which is below the stock’s current trading price. As the market continues to evolve, it will be important to monitor whether analysts adjust their ratings or revise their price targets in response to new developments.

Conclusion: Navigating the AI Investment Landscape

BigBear.ai’s recent success is undeniably impressive, but it also serves as a reminder of the complexities and risks associated with investing in the AI sector. While the company’s focus on AI-powered decision-making and its strong government contracts provide a solid foundation, the challenges posed by market saturation, competition from established players like Palantir, and the risks of dilution cannot be overlooked. Investors would do well to approach BigBear.ai and other AI-driven stocks with a critical eye, leveraging data-driven tools like TipRanks’ Smart Score to uncover top-performing stocks and make informed investment decisions. As the AI market continues to grow and evolve, staying informed and remaining cautious will be key to maximizing returns in this high-potential yet volatile sector.

Disclaimer:

The opinions expressed in this article are solely those of the featured investor and are intended for informational purposes only. Always conduct your own analysis before making any investment decision.