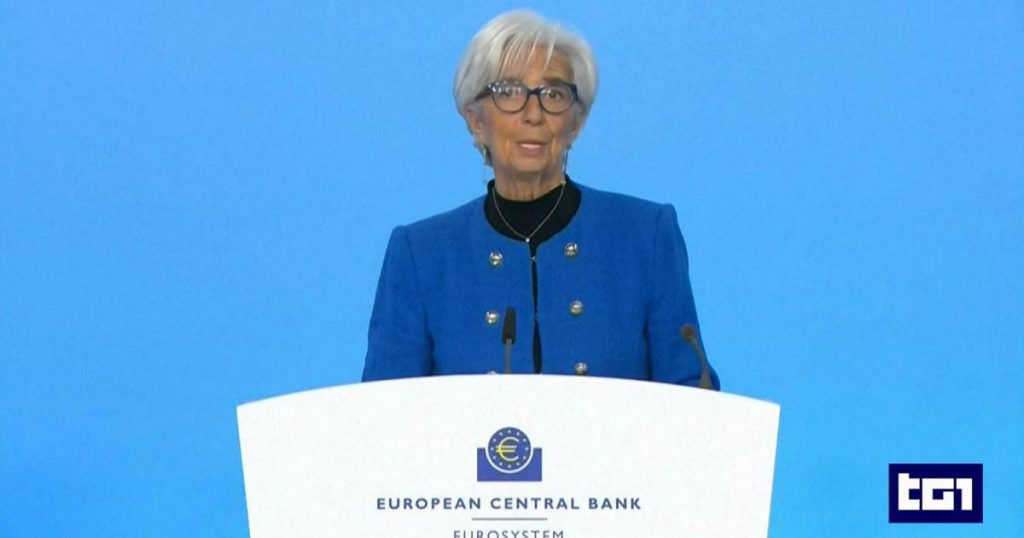

The ECB’s Rate Cut: A Strategic Move

On January 30, 2025, the European Central Bank (ECB) announced a significant decision: a 25-point reduction in interest rates. This move is a strategic response to the current economic climate, aiming to stimulate growth and support recovery. The ECB’s decision comes at a critical time, as European economies, including Italy, face a myriad of challenges, from high unemployment rates to sluggish economic growth. The rate cut is expected to have far-reaching effects on various sectors, particularly on savers and mortgage holders.

Impact on Italian Savers

For Italian savers, the rate cut is a double-edged sword. On one hand, lower interest rates mean reduced returns on savings accounts and other fixed-income investments. This could be particularly challenging for retirees and individuals who rely heavily on interest income. On the other hand, the ECB’s move is intended to encourage spending and investment, which could eventually lead to economic growth and higher returns in the long run. However, the immediate impact on savers is likely to be a reduction in their purchasing power, as the interest they earn on their savings diminishes. Financial experts advise savers to diversify their portfolios, considering alternative investments such as stocks, bonds, and real estate to mitigate the negative effects of low interest rates.

Benefits for Mortgage Holders

The rate cut is expected to bring significant benefits to Italian mortgage holders. Lower interest rates mean reduced monthly payments, providing a financial relief to many households. For those with variable-rate mortgages, the reduction in rates will be immediately noticeable, allowing them to allocate more funds to other expenses or savings. This could also stimulate the housing market, as more people may find it easier to afford homes, leading to increased demand and potentially higher property values. However, it is crucial for mortgage holders to be cautious about over-leverage, as lower interest rates can sometimes create a false sense of financial security, leading to reckless borrowing.

Unemployment and Economic Growth: The Istat Data

In conjunction with the ECB’s decision, Istat, Italy’s national statistics institute, released new data on unemployment and economic growth. The figures paint a mixed picture of the Italian economy. Unemployment rates remain high, particularly among young people and in southern regions, which continue to struggle with economic stagnation. However, there are glimmers of hope, as some sectors, such as technology and tourism, show signs of improvement. The Istat data also indicates a slight uptick in economic growth, though it remains below the levels needed for a robust recovery. The ECB’s rate cut is seen as a complementary measure to support these nascent positive trends, by making credit more accessible and fostering a conducive environment for business expansion and job creation.

Challenges and Opportunities

Despite the potential benefits of the ECB’s rate cut, there are several challenges that need to be addressed. One of the primary concerns is the risk of inflation, which could rise if the economy overheats due to too much liquidity. Central banks need to strike a delicate balance between stimulating growth and maintaining price stability. Additionally, the effectiveness of the rate cut will depend on how well it is transmitted to the real economy. Banks and financial institutions play a crucial role in this process, and it is essential that they pass on the benefits of lower rates to consumers and businesses. For Italy, the road to recovery is long, and the rate cut is just one of many steps needed to address structural issues and achieve sustainable economic growth.

Future Outlook and Policy Implications

Looking ahead, the ECB’s decision is likely to remain a focal point in economic discussions. While the immediate effects are clear, the long-term impact will depend on a variety of factors, including global economic conditions, domestic policy choices, and the resilience of the Italian economy. Policymakers and financial experts are closely monitoring the situation, ready to implement additional measures if necessary. For Italian savers and mortgage holders, staying informed and proactive is key. It is advisable to consult financial advisors to make well-informed decisions that align with individual financial goals and risk tolerance. The ECB’s rate cut is a significant step, but it is part of a broader strategy to ensure economic stability and prosperity for all.