The Trump Administration Cracks Down on the Consumer Financial Protection Bureau

The Trump administration made a significant move late on Saturday, instructing the Consumer Financial Protection Bureau (CFPB), an independent government agency tasked with protecting consumers from corporate fraud and scams, to halt much of its work. This directive came amid a broader overhaul of the federal bureaucracy, a key focus of the Trump presidency. Russ Vought, the newly confirmed director of the Office of Management and Budget (OMB) and now the acting head of the CFPB, sent an email to agency staff outlining the changes. Vought instructed employees to stop issuing proposed or formal rules, cease pending investigations, refrain from opening new ones, halt stakeholder engagements, and avoid issuing public communications. He framed the move as an act of fiscal responsibility, stating that he was acting "as a faithful steward of the Bureau’s resources" and committed to carrying out President Trump’s agenda.

This development marked the latest step in a series of actions aimed at reshaping the federal government under Trump’s leadership. The CFPB, established in 2011 under President Barack Obama as part of the Dodd-Frank Act, has long been a target of Republican criticism. Its mandate to protect consumers from abusive financial practices has often put it at odds with corporate interests. Now, with Vought at the helm, the agency appears to be undergoing a dramatic shift in its operations and priorities.

Elon Musk’s Role in the Overhaul of the CFPB

The directive to halt the CFPB’s work followed another significant development: the involvement of Elon Musk’s Department of Government Efficiency, or DOGE. According to sources familiar with the matter, DOGE representatives gained access to the CFPB’s internal systems, including personnel rolls and financial records, in recent days. This access was part of a broader review of the agency’s operations, reportedly aimed at identifying inefficiencies and areas for cost-cutting. Additionally, union representatives for CFPB employees reported that Musk’s deputies were added to the agency’s email directory and were even spotted in the CFPB building last week.

Musk’s involvement in the federal bureaucracy is part of a larger effort by the Trump administration to overhaul government operations. The president has tasked Musk with addressing government efficiency and cutting waste, a mission that has already begun to take shape in various federal agencies. While the specifics of Musk’s role remain unclear, his influence appears to be growing, particularly in agencies like the CFPB.

Trump’s Appointment of Russ Vought as Acting Head of the CFPB

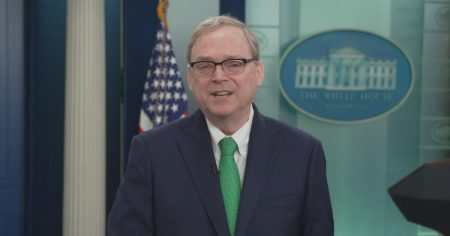

The changes at the CFPB were further solidified with the appointment of Russ Vought as the agency’s acting head. Vought, who was confirmed as the director of the OMB just days earlier, has a long history of advocating for limited government and fiscal conservatism. His appointment to lead the CFPB came after President Trump fired the agency’s previous director, Rohit Chopra, last week. Chopra, a Democrat, had been a strong advocate for consumer protections during his tenure.

Vought’s appointment was met with skepticism from consumer advocacy groups and Democratic lawmakers, who fear that his leadership will weaken the agency’s ability to protect consumers. Vought’s background includes a stint as OMB director during Trump’s first administration, where he played a key role in shaping the president’s budget priorities. He is also associated with the Heritage Foundation’s Project 2025, a conservative policy initiative aimed at restructuring the federal government.

Financial and Operational Changes at the CFPB

One of the most significant financial changes under Vought’s leadership is the decision to halt the CFPB’s access to unappropriated funding from the Federal Reserve. Vought described the agency’s current balance as "excessive in the current fiscal environment" and vowed to turn off the "spigot" of funding that he claims has contributed to the CFPB’s unaccountability. This move could have far-reaching implications for the agency’s ability to operate independently, as it has historically relied on funding from the Federal Reserve rather than congressional appropriations.

The financial changes are just one part of a broader effort to rein in the CFPB’s activities. Vought’s email to staff outlined a sweeping set of restrictions that effectively bring much of the agency’s work to a standstill. From halting rule-making and investigations to ceasing public communications, the memo signals a dramatic shift in the CFPB’s mission and priorities. These changes have raised alarms among consumer advocates, who argue that the agency’s independence and effectiveness are being undermined.

Public Reaction and the Future of the CFPB

The Trump administration’s actions at the CFPB have sparked a flurry of reactions from lawmakers, consumer advocates, and the public. Sen. Elizabeth Warren, a key architect of the CFPB, was among the most vocal critics, taking to social media to denounce the changes. Warren highlighted the agency’s track record of returning over $21 billion to consumers and accused Vought of giving "big banks and giant corporations the green light to scam families." Her comments reflect a broader concern that the agency’s consumer protection mission is being sacrificed for ideological and political reasons.

Meanwhile, Elon Musk added fuel to the fire with a provocative post on his social media platform X, where he wrote "RIP CFPB" and shared a 404 error message that began appearing on the agency’s website. The move was interpreted by some as a sign of the agency’s impending demise under the Trump administration. While the exact future of the CFPB remains unclear, one thing is certain: the agency is facing unprecedented challenges as it navigates a transition in leadership and a fundamental shift in its mission.

Conclusion: A New Era for Consumer Protection?

The Trump administration’s actions at the CFPB represent a significant turning point for consumer protection in the United States. By halting the agency’s operations, appointing a new leader with a conservative track record, and cutting off its funding, the administration is charting a new course for the CFPB—one that appears to prioritize fiscal conservatism and government efficiency over consumer advocacy. While supporters of the changes argue that they are necessary to rein in an overreaching bureaucracy, critics warn that they will leave consumers vulnerable to abuse and exploitation.

As the CFPB enters this new era, the stakes couldn