Meta Platforms Comprehensive PERFORMANCE REVEALS

Meta Platforms (META), one of the world’s most influential and innovative technology companies, has embarkd a new chapter with its stock performance tracking recent advancements in the tech sector. As investors closely monitor Meta’s stock, The Mkership ofاة shares continues to rise, with a recent 20-day streak increasing Meta’s stock to an all-time high. Mirror Candidate group’s sentiment survey, which found Meta shares to have a 100% positive sentiment, underscores the company’s strength in crucial sectors and its momentum in its broader ranking.

The initial push Meta feels to set a new high stems from this stock’s strong performance since its emergence as one of the world’s largest payments platforms. Following a record-breaking 20-day rally starting on Feb. 14, Meta shares are up 1.44% to reflect stream of positive news from its diverse business pillars, such as its investment in AI and big data analytics, as well as data-driven insights for investors. This rally, spanning ten consecutive days, broke a previous two-day record, clearly showcasing Meta’s capability to capitalize on trends in-verified by its robust financials.

Meta caps its recent rally on heightened optimism from its previous leadership by incoming U.S. President Donald Trump, who⏱曉 cận, a pivotal day in history, signaling Meta’s focus on longer-term growth. Despite the tapering of Word News from the previous administration, Meta’s 23 trading days of consecutive gains since Jan. 16, which saw the U.S. ban on TikTok expired, highlights Meta’s ability to lock in market momentum through its aggressive strategy of leveraging data to uncover top performing stocks. In addition to its AI strategy, Meta has increased its AI infrastructure by up to $65 billion, fueled by a growing demand from emerging market economies for efficient AI solutions.

For the current year, Meta shares have climbed 27%, surpassing the 3% S&P 500 gaining in the same timeframe, a testament to its resilience and impactful investing philosophy. While the market has faced challenges like China’s Artificial Intelligence (AI) start-up DeepSeek threats and trade.WARNING, Meta’s success is attributed to its strongest performance during the fourth-quarter results, which outperformed Wall Street aggressively projected expectations. Meta’s CEO, Mark Zuckerberg, emphasizes the company’s strong stance on AI infrastructure, highlighting Meta’s ability to capture the next wave of IT investment opportunities.

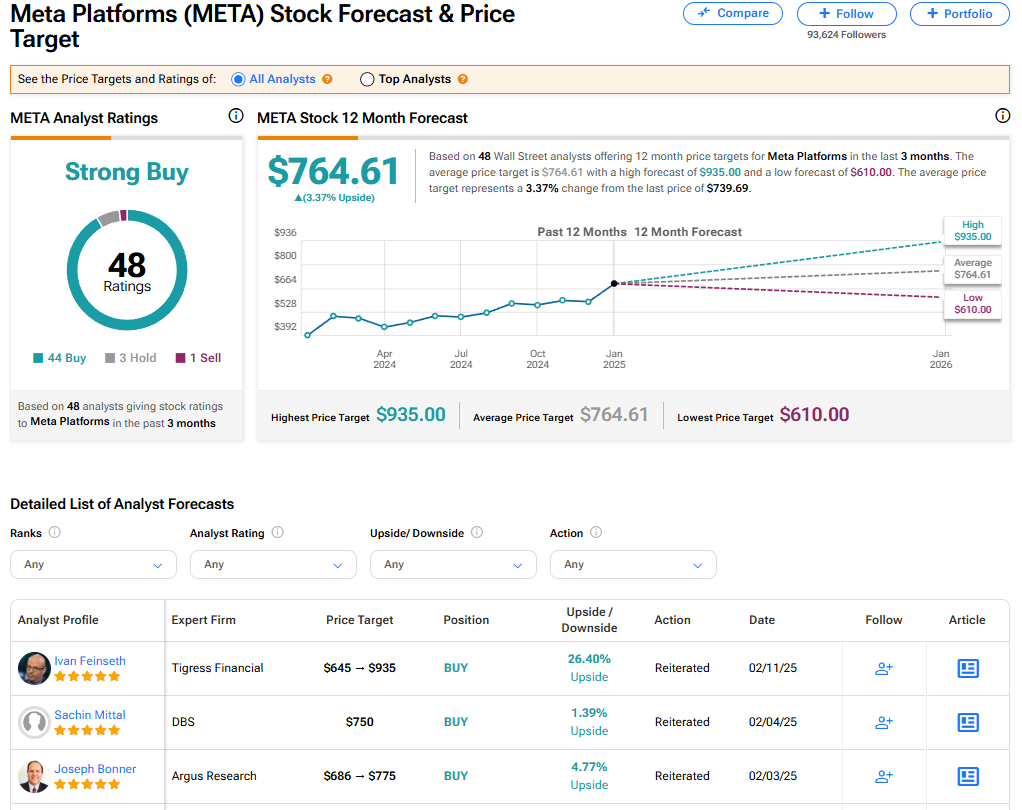

Despite these highs, Meta remains cautious, with aزimation strong buy rating from 48 Wall Street analysts, averaging 3.37% upside from current levels. This rating reflects Meta’s strong financial position, unwavering rationale for its AI strategy, and a growing audience base across 40+ countries. As Meta continues to lead in innovation and profitability, it stands to capitalize on future opportunities, amid expectations of a strong fourth and fifth fiscal year.

The company’s strong performance underscores Meta’s potential to be one of the fastest-growing tech stocks on the planet. As investorsclo the door toDONALD TRUMP in February 2020, this domino effect of positive news and data-driven insights further reinforces Meta’s trajectory forward. With its focus on AI, innovation, and growth strategies, Meta has every reason to see itself as a key player in the next decade of the tech landscape.