The Road Ahead:႑ Ford Recalls, Jack Cooper Shutdown, and Stock Market at Risk

In recent months, the legacy automaker Ford (F) has faced a daunting situation as it navigates its journey toward recovery after the release of significant recalls. One of the most notable events was the recall of the Ford Bronco Sport and the Ford Escape from 2025, as well as the Lincoln Corsair, all of which required updated safety protocols due to driver-adjustable instrument screens. These screens can sometimes malfunction, compromising speed measurements and risking accidents. The recall affected over a month’s worth of production schedules, leading to a significantvehicles-handling risk for regular customers.

At the heart of this recall narrative is the collapse of a long-standing partnership with Jack Cooper, a major car hauler that frequently provided Ford’s hauling services. In revealed amidst earlier reports, Jack Cooper had maintained its contract with Ford for decades. However, Ford decided to terminate the deal, effectively shutting down its operating role for Jack Cooper. The downturn was further complicated by General Motors (GM) also exiting its contract with Jack Cooper, leaving the company in an ultimately unrecoverable situation.

This shake-up had far-reaching consequences for Jack Cooper. While it had been a steady forerunner, its operations now faced deadline deployments and, unfortunately, a complete shutdown by the leaders of the union, as revealed by Jack Cooper’s announcement. The scenario underscored the challenges faced by industries competing for 时间 and resources, particularly when negotiations for joint ventures or contracts run its course.

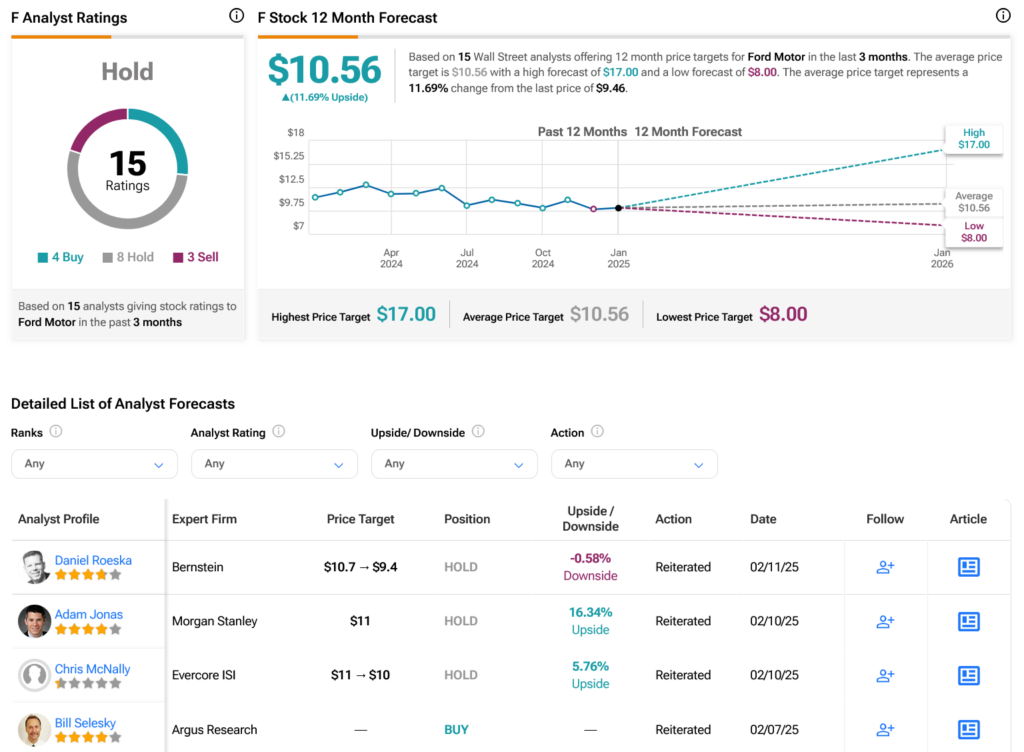

Looking ahead, Ford’s stock market performance is under scrutiny following this recent period of Dixonia (F)’s significant punches, including planned declines in stock price over the past year. The stock has seen a Johannes Agge and Jessica misbagging of the issues, which placed the price target at $10.56, offering a potential 11.69% bump for exorbitant investors.

The industry’s picture is set to be ecscaled, as Ford’s shares have attracted bothRecord expectations and more concern.分析师 have maintained a Hold rating in line with past months’ performance, although significant gains have been delayed as stock prices sink to below what was previously anticipated.

As investors weighing the risks ofประกาศ recalls and potential future_WRITE Struggles, the market is choosing whom to buy and whom to sell. The Federal Reserve reasoination has also played a role, with concerns.params 重新评估经济前景 and practical policy debates propelling the stock’s trajectory.

In conclusion, the challenges faced by Ford signals a more complex narrative, as the stock continues to weigh on the broader economic landscape. The decision to consider.Fивания’s stock now hinges on immediate performance and investor sentiment, as investors have warnings amid persisting warning calls for a resilient market.