The Strategic Move: Banks Acquiring Market Share Through Deals

In the ever-evolving landscape of the banking industry, institutions are continually seeking ways to expand their influence and strengthen their positions. One of the most common strategies employed by banks to achieve this is through acquisitions or public exchange offers aimed at acquiring or merging with other financial institutions. These moves are not mere risks but calculated steps to gain a larger share of the market, enhance operational efficiency, and diversify service offerings. The latest example of this trend is Bper, an Italian bank, which has launched a significant public exchange offer to acquire Popolare di Sondrio, another Italian banking group.

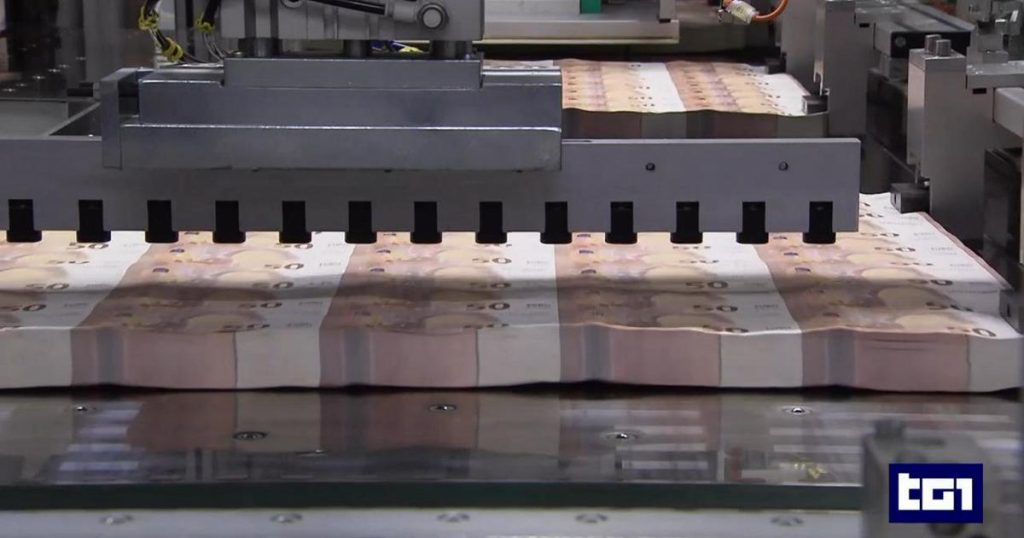

Bper’s Bold Move: A 4.3 Billion Euro Offer

Bper, one of Italy’s prominent banking groups, has made headlines with its ambitious move to expand its market presence. The bank has launched a public exchange offer valued at 4.3 billion euros to acquire Popolare di Sondrio, a well-established Italian bank. This deal, set to conclude by February 7, 2025, highlights Bper’s strategic intent to consolidate its position in the highly competitive Italian banking sector. By acquiring Popolare di Sondrio, Bper aims to leverage the latter’s extensive network, customer base, and regional expertise to bolster its own operations and reach.

The Broader Context: Consolidation in the Banking Sector

Bper’s move is part of a larger trend in the banking industry, where consolidation has become a key strategy for survival and growth. In recent years, the banking sector has faced numerous challenges, including regulatory pressures, digitization, and fierce competition. To remain competitive, many banks have turned to mergers and acquisitions (M&As) as a way to reduce costs, improve efficiency, and expand their market reach. The Italian banking sector, in particular, has witnessed a wave of consolidation, with several smaller and regional banks being acquired by larger players.

Strategic Implications of the Deal

The acquisition of Popolare di Sondrio by Bper carries significant strategic implications for both institutions and the broader banking landscape. For Bper, this deal represents an opportunity to strengthen its foothold in key regions, enhance its product offerings, and gain access to a larger customer base. Popolare di Sondrio, on the other hand, will benefit from Bper’s greater resources, advanced technological capabilities, and broader market presence. The integration of the two banks is expected to create a more robust and competitive entity, better equipped to meet the demands of a rapidly changing financial environment.

The Human Side: Impact on Customers and Employees

While the financial and strategic aspects of the deal are crucial, it’s equally important to consider the human element. For customers of both banks, the acquisition could mean improved services, better accessibility, and a wider range of financial products. However, it may also lead to changes in existing relationships, as branches may be consolidated or restructured. Employees, too, may face uncertainties, such as potential job redundancies or shifts in roles, as the two organizations integrate their operations.

The Future of Banking: Opportunities and Challenges

As Bper and Popolare di Sondrio navigate this significant transition, the deal serves as a reminder of the opportunities and challenges inherent in the banking sector. Consolidation, while necessary for survival, requires careful planning and execution to ensure success. The integration process must be managed diligently to retain customer trust, maintain employee morale, and realize the expected synergies. Looking ahead, the success of this deal could set a precedent for further consolidation in the Italian banking sector, shaping the future of banking in the region for years to come.

In conclusion, Bper’s acquisition of Popolare di Sondrio is a testament to the dynamic and competitive nature of the banking industry. As banks continue to evolve and adapt to changing market conditions, strategic moves like this will play a pivotal role in determining their future success.