The New Tariff Landscape: A Comprehensive Overview

Under the proposed new tariff measures, exports from Mexico and Canada to the United States will face a 25% surcharge. This significant increase is likely to have far-reaching implications for trade relations and economic activities in North America. Additionally, China, a major trading partner, will be subjected to an additional 10% tariff on its exports to the U.S. These new tariffs are not the end of the proposed changes; the Trump administration is also considering imposing duties on the BRICS nations—Brazil, China, India, and South Africa. These countries could face a 100% increase in tariffs if they choose to use currencies other than the U.S. dollar in their trade transactions. The scope of these changes highlights the administration’s intent to reshape global trade dynamics, but it also raises concerns about potential economic repercussions.

The Impact on North American Trade

The 25% tariff on Mexican and Canadian exports to the United States will significantly affect both countries’ economies. Mexico, in particular, is a critical trade partner, with numerous industries, including automotive and manufacturing, heavily reliant on the U.S. market. Similarly, Canada, a major exporter of natural resources and automotive parts, will also face substantial challenges. The increased costs are likely to be passed on to American consumers, driving up prices for a wide range of goods. This could lead to higher inflation rates, potentially exceeding 3%. The economic slowdown resulting from these higher costs could result in the loss of nearly 700,000 jobs in the U.S., exacerbating unemployment and placing additional financial burdens on families.

The Global Economic Ripple Effect

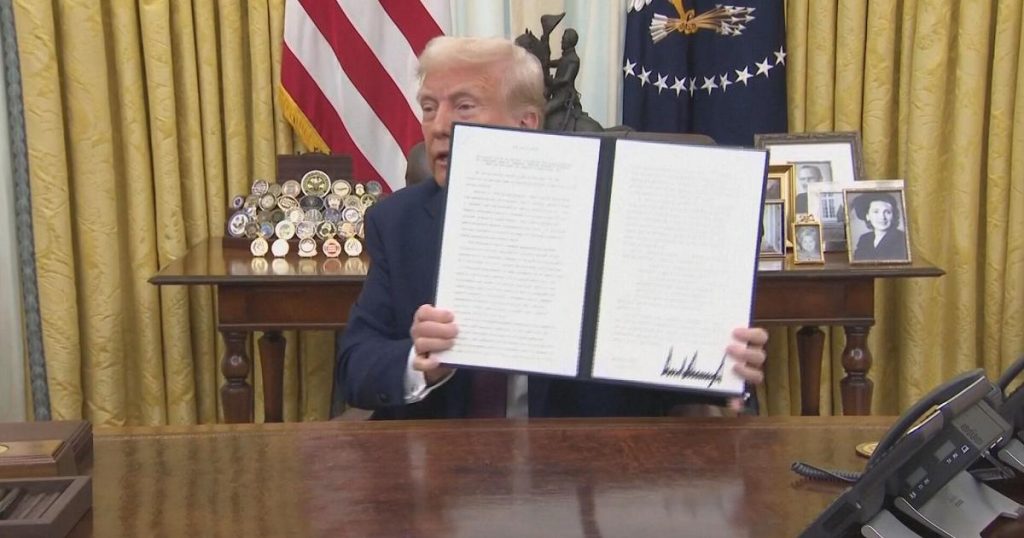

The proposed tariffs are not limited to North America; they will have a global impact. The additional 10% tariff on Chinese goods will further strain the already tense U.S.-China trade relationship. This could lead to retaliatory measures from China, intensifying the trade war and potentially causing more economic instability. The potential 100% increase in tariffs for the BRICS nations, especially if they use non-dollar currencies, could disrupt global trade patterns and weaken the U.S. dollar’s dominance. European countries, though not directly targeted, could also be affected as they navigate the complex web of global trade. President Trump’s statement that "they treated us very badly" underscores the administration’s dissatisfaction with existing trade agreements and its willingness to take drastic measures to address perceived imbalances.

The Market Reactions and Economic Consequences

The announcement of these new tariffs has already sent shockwaves through the financial markets. Stock prices have fallen, and the U.S. dollar has strengthened, reflecting increased uncertainty and risk. The potential for higher inflation and economic slowdown is a significant concern. Families could face an additional tax burden of almost a thousand dollars this year, further straining household budgets. The broader economic slowdown could lead to reduced consumer spending, decreased business investments, and a potential recession. The impact on the job market is particularly concerning, as the loss of 700,000 jobs would have severe social and economic consequences.

The Corporate Perspective

The proposed tariffs have already alarmed many multinational corporations that have invested heavily in North America. For example, Japan, with over 1,300 companies in the region, stands to be significantly affected. Taiwan, which is planning to open a gigafactory for Nvidia in Mexico, will also face increased costs and potential delays. The automotive sector, with companies like Pirelli, Stellantis, Toyota, Volvo, and Honda, has a strong presence in both Mexico and Canada. These companies will need to reassess their supply chains and production strategies to mitigate the impact of the new tariffs. The potential for reduced profitability and increased operational costs could lead to strategic shifts, including the relocation of production facilities or the exploration of new markets.

The Road Ahead: Navigating the New Tariff Regime

As the new tariff measures are implemented, the focus will be on how the U.S. and its trading partners will navigate the changing landscape. The potential for trade negotiations and agreements to mitigate the impact of these tariffs is a key factor to watch. Multinational corporations, in particular, will need to be agile and adaptable to maintain their competitive edge. The broader economic implications, including inflation, job losses, and consumer impacts, will also need to be closely monitored. The road ahead is uncertain, but the actions taken by governments, businesses, and consumers will play a crucial role in shaping the future of global trade.