The Emergence of DOGE and Its Role in Government Efficiency

In a move that has sparked both intrigue and concern, Elon Musk’s Department of Government Efficiency, or DOGE, has initiated a comprehensive review of the Consumer Financial Protection Bureau (CFPB). Established to protect consumers from corporate fraud and scams, the CFPB has now come under the scrutiny of DOGE, an entity tasked with enhancing governmental functionality. This development marks a significant step in DOGE’s efforts to streamline and optimize government operations, as envisaged by Musk.

DOGE’s Access and Actions Within the CFPB

DOGE’s review of the CFPB has been marked by swift action. Representatives from Musk’s team have gained access to internal systems, including sensitive personnel and financial records. This access has enabled them to scrutinize the agency’s inner workings thoroughly. Notably, three of Musk’s representatives—Chris Young, Nikhol Rajpal, and Gavin Kilger—have been added to the CFPB’s email directory, signaling their active involvement. Their presence in the CFPB building underscores the hands-on approach DOGE is taking in this review.

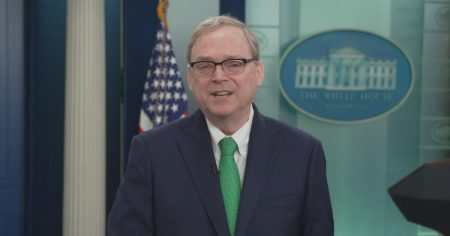

Political Shifts: Leadership Changes and Presidential Influence

The political landscape surrounding the CFPB has seen notable shifts, with President Trump appointing Russell Vought as the acting head of the agency. This move, part of a broader strategy to align the CFPB with the administration’s goals, has been met with interest. Trump has expressed strong support for DOGE’s efforts, emphasizing the need to uncover and address corruption. His stance is clear: this initiative is a result of his insistence on reform, reflecting his commitment to reshaping government agencies.

The CFPB’s Role and Controversies

The CFPB, an independent agency operating under the Federal Reserve, plays a crucial role in consumer protection. It addresses issues like questionable student loan practices and excessive bank fees. However, its operational independence has drawn criticism, particularly the lack of Congressional oversight. This unique structure, while allowing autonomy, has also led to political tensions. Critics argue that such independence can lead to unchecked power, while supporters highlight its effectiveness in safeguarding consumer rights.

Trump’s Agenda and the Future of the CFPB

President Trump’s actions regarding the CFPB, including the removal of former director Rohit Chopra, indicate a deliberate effort to reshape the agency. This move is part of a broader strategy to influence key government bodies, aligning them with the administration’s objectives. The CFPB’s website going dark, resulting in a 404 error, has raised eyebrows, prompting speculation about the agency’s future operations and accessibility.

Implications and Prospects for Consumer Protection

The involvement of DOGE and the leadership changes at the CFPB have significant implications for consumer protection. While the administration’s focus on efficiency and transparency is commendable, concerns about the agency’s effectiveness and autonomy persist. As the situation unfolds, the balance between government efficiency and consumer safeguarding will be crucial. The outcome of DOGE’s review and the new leadership’s approach will shape the future of the CFPB, influencing its role in protecting consumers in an evolving financial landscape.